Top 10 predictions and challenges for the accounting profession

The accounting profession has changed radically in the last decade, and the momentum of change has increased. If we do not move with the times, we risk being left behind in the wake of more agile and adaptable businesses. Although the accounting profession is often seen as being stable and traditional, the accelerating pace of change will affect it in several widely differing areas. According to industry analysts, the top ten challenges that lie in store for the accounting industry can be summed up as follows:

- Client retention in the face of commoditization of compliance will become an issue

In the cumbersome systems of the past, the help of an accountant was vital to businesses that wanted to ensure full compliance. Many accounting firms made much of their revenue through compiling tax returns, but as Rob Nixon points out in his 2015 book “Remaining Relevant: The Future of the Accounting Profession”, that’s all changing now. Repetitiveness breeds systemization, and thereafter, commoditization.

Cloud accounting services are increasingly making it possible for businesses and individuals to keep their own information in order, with the accountant just doing a few quick final checks before submitting returns – if they are even asked to do this much. E-filing allows your clients to submit information in a couple of clicks of a mouse.

Of course, these simplifications are a good thing, but the accounting profession will need to adapt its role in business relationships. Assistance with compliance will soon be the least of your tasks. That makes the accountant’s job more interesting, but also a whole lot more challenging, because an easy, routine income stream is dwindling through the adoption of disruptive technologies.

- Staffing challenges in an ageing professional talent pool will affect your practice

The Annual Accounting Operations and Technology Survey identified a worrying trend. Over 60 percent of practices reporting that finding and retaining talent was becoming a challenge. For the last 16 years, the demand for accounting graduates has exceeded supply, and statistics show that up to two thirds of qualified accountants are due for retirement over the next 20 years.

Much has been written about challenges inherent in attracting, engaging and retaining millennial employees, the generation that could potentially fill this gap. Briefly, the adoption of the latest technologies and the reduction in office time this can bring with it will be of importance. In addition, opportunities for personal and professional development through learning and mentorship will pay a role, as will a clear career path and input into management decision-making.

An additional issue raised by certain commentators is the image of accounting as a profession. To an outsider, it may seem rather stuffy, and in need of a makeover to attract young talent seeking interesting, challenging and meaningful work. With the changes in the accounting profession’s environment, this might be easier to achieve than it seems on the surface. After all, the role of accountants is set to change in interesting ways.

- Marketing and selling your services will become essential

A few short years ago, the very idea of marketing or selling accounting services was anathema. And when marketing initiatives were undertaken, it was all about the company rather than the client.

Statements like “We are reliable”, “We are experienced”, or “We have access to the best specialists in the field” assured potential clients of the reputable nature of accounting firms. But now your potential clients have changed. They will certainly be interested in reputation, reliability and specialist knowledge, but only after they have ascertained what you can do for them. And if you’re doing the same things that everyone else is doing, you can expect, at best, mediocre results.

Developing and maintaining differentiation will give firms the competitive edge. The question is no longer just “What can you do for me?”, but also “How does this differ from what I can get anywhere else?” Vice chair for Ernst and Young, Beth Brooke, says that specialization may be the key.

She is not alone in this belief, a CCH survey found that 66 percent of firms said that specialization in specific areas of practice would be necessary to future growth. In this environment, forming alliances with other professionals becomes increasingly important in generating new business opportunities. Over half of the CCH respondents said that they either already belonged to a specialized or regional network, or would join one within the next three years.

- Time-based billing becomes history: what now?

The clients of today are looking for a value-add. They want to know upfront what will be delivered and how it will benefit them. Time becomes less of an issue than value, and your clients will be more reluctant to offer any firm a time-based carte blanche. Value-based pricing is still relatively rare in the accounting industry, but multiple sources agree that it is the wave of the future, and it can be good for accountants too.

With value-based billing, you don’t lose revenue because your practice is efficient, and the client doesn’t have to pay for wasted time if your practice is inefficient. Accountants Daily recommends pricing per client rather than per service, taking customers’ individual value drivers into account.

That means using the “five Cs” of value to the advantage of your practice and your client:

- Comprehending the value of the service you provide to the client.

- Creating value for clients

- Communicating the value of what you are doing to your client

- Convincing clients that what is offered is worth the cost

- Capturing that value through strategic pricing.

Hourly pricing makes clients focus on hours, and with the increased automation our hours worked and therefore billed on a client will drop. While value-based pricing makes them focus on value. As we’ll see, a large amount of perceived value depends on your relationships with your clients.

- Revenue from business advisory services becomes a major income stream

Your ability to flex your financial know how on behalf of your clients’ businesses by offering your professional advice isn’t just a value-add that contributes to our previous point: it could become your core business.

In the past, compliance requirements mired accounting practices down in routine number-crunching, but there are projections of business advice services constituting up to 80 percent of accounting practices’ revenue. The commoditization of compliance doesn’t have to be all bad news. Now you can use saved time to become the trusted advisor who gives your clients the financial management advice they need to achieve their business or personal goals.

Many businesses lack sound financial management skills and cannot afford the full-time services of a qualified person. Your abilities and experience could prove invaluable to their success while ensuring that you retain and build on the trusted status you deserve.

At the same time, having the benefit of financial advice from someone who already understands the client and his or her business interests makes clients less likely to “jump ship” in favour of one of the many “cheap” accounting services that are springing up. By building a reputation for your individualised financial advice, you will also get referrals and new business, helping you to grow your practice in an ever-changing business environment.

- Leveraging technology, automation and artificial intelligence will be (and already is) vital

Before long, 90 percent or more of your practice management will be cloud-based. Hard drives will be all-but obsolete with limited technical support available when you need it. Your employees will be working on the go or even from home, and you’ll want to be able to access information no matter where you are. Moving to the cloud, if you haven’t already done so, should be your next priority. It will help you to build on your advisory role, as you will have access to real time monitoring of financials.

Automated data capture and analytics are already available, offering you an excellent way to realize efficiencies without added clerical input. Of course, that means keeping abreast with the latest technologies, and you might well find that your IT consultant becomes as important to your business as your consulting services are to your clients. Artificial intelligence may be just as important as your personal intelligence in keeping your practice running. It takes care of the routine tasks; you take care of the aspects that require more creative thinking.

The Next Generation Accountant Project found that CFOs consider technological expertise the second most important skill in the accounting industry after financial expertise. 52 percent of the CFOs surveyed said that tech training for staff would be a high priority within the next two years. It makes sense. Clients will also be asking for tech solutions to traditional accounting problems. They will expect your firm to have the expertise to advise them.

- Alignment with global accounting and business standards

Once, global business activities were the province of a few multinational companies and exporters. Now, many businesses are no longer limited by their geographical location. Thus, the Association of Chartered Certified Accountants (ACCA), predicts that globalization will present both opportunities and challenges.

Accountants will be expected to accommodate the different ways business is done around the world, will need to be able to deal with regulations across multiple countries, and can expect to see accounting standards changing to present a more globally uniform methodology. Once again, these are all positive changes, but they will necessitate internal change in the practice to maximize its ability to take advantage of new global opportunities.

The ability to speak more than one language, deal with cultural differences and manage a diverse workforce will be of increasing importance, and adaptability will be the order of the day.

- The rise of global outsourcing

Global outsourcing is changing the competitive landscape. Highly competent people in countries with weak currencies are willing and able to take on traditional accounting tasks for a fraction of what they would cost locally. Already, we see cut-price accounting services springing up. There may be a local agent, but much of the work is done offshore.

Fortunately, price is not the only competitive advantage that can be leveraged. Your practice is better able to develop in-person relationships with clients, and because you’re not focusing on driving fees down as low as you can, you can focus on driving value up as high as possible.

At the same time, your practice will be under pressure to preserve local jobs. 72 percent of CFOs said that they see the preservation of local employment as a challenge they are already confronting or expect to confront in the near future. Your ability to do so will depend on your practice developing its competitive edge and marketing it effectively.

- Dealing with economic volatility to remain a primary skill: with added innovations

When volatility sets in, businesses and investors become more cautious, and the subdued environment limits regular income streams derived from audit and tax services. Already the Big Four accounting firms are diversifying their service offerings to make up for this. Philip Yuen of Deloitte Singapore says that accounting firms are seeing changing demand patterns, with advisory services, risk management and restructuring consultations being among the services that are in demand when companies seek to tighten their belts to survive a tough economic environment.

As we have seen, consultation on strategy is increasingly becoming part and parcel of what clients will expect from their accountants. Knowing how to help firms to cope with economic volatility and fluctuating currencies will become key to a practice’s ability to maintain and grow its market share.

- Managing time and communications will be an even more delicate business than it was before

These changes and developments will present accountants with a final challenge: that of managing communications. With clients expecting value and personalized service, and with emails streaming in, sometimes from every corner of the globe, extended consultation meetings and more, managing the time spent on communications will become as important to maintaining efficiency as leveraging technology will be.

There will still be tasks that only you can perform, and these tasks require focus. Whereas you could previously have asked your receptionist to field phone calls, your clients now expect personal and prompt responses via email, and these communications are interspersed with non-actionable information.

Your time management abilities will be among your most useful skills. Getting side-tracked or off schedule will have an even greater knock-on effect than it did in the past. Avoid a snowball effect by maintaining a disciplined approach.

Meeting challenges will make your practice thrive

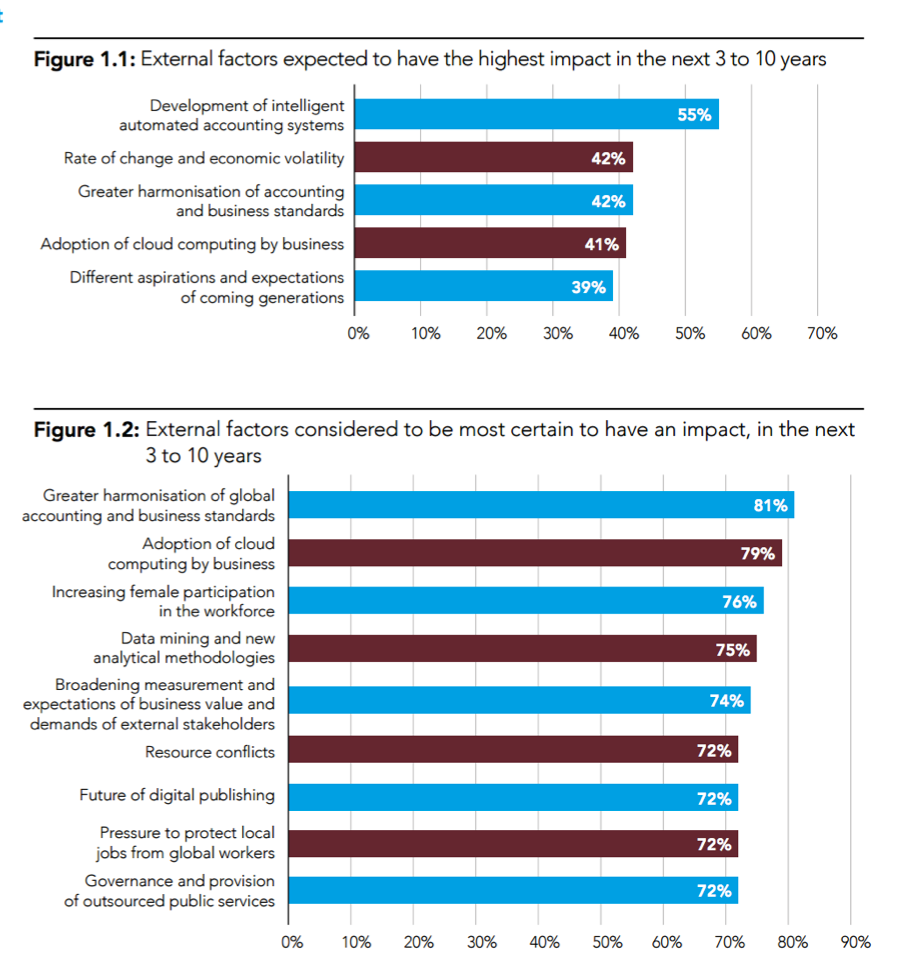

The challenges we’ve just discussed, plus a few other expected changes and change drivers are summed up in the results of the recent AACA poll in the graphs below:

Ignoring the many changes and developments in the external environment that will impact your business is clearly not an option, but with forethought and adaptability, meeting them head on, and even pre-empting them when possible, will help your practice to thrive as it transforms into a much more holistic financial management service.

I’m ready to hazard a guess that you’ll enjoy the results. Increasingly, the routine number crunching will be replaced by strategic thinking on behalf of your clients, and an opportunity for them to realize and benefit from the true value of your expertise.