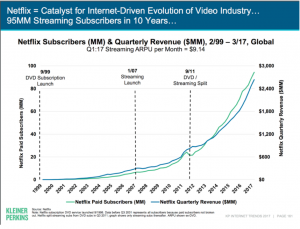

Last week we looked at the top insights from this years Mary Meeker Internet trend reports (full deck). One of these was the dramatic transformation of the media landscape, and the rise and rise of Netflix which is now the fifth biggest ‘TV’ network in the US (based on minutes watched), and has 35% of all desktop streaming video and the corresponding impact on CableThe report points out the challenges facing the traditional cable companies and a good place for us to explore is how does this relate to little old NZ and Sky?

Firstly let’s look at some key media insights from Mary Meeker’s report:

- Netflix is growing exponentially!

- Netflix is a different model to cable TV, – Cable use a bundling strategy (which I unpacked here, here and here) to maximise revenue and customers only watch <10% of the channels they pay for. And compared to Netflix (or Lightbox) the cable annual ARPU (annual revenue per user) is 10-15x higher than Netflix – again we previously looked at this.

- Cable companies are facing churn, globally net subscriber numbers are down 2.4%

- Not only do cable companies have a churn problem their cost base is blowing out programming costs have doubled since 2006

- And while this is hard to quantify the investment and direct return from personalisation the user experience gains are so much higher in digital businesses than cable business that is just bundling more channels. There is a saying that there isn’t one Netflix there is 98m variants of it. This not only increases the customer engagement but allows better purchasing of content and it is estimated that Netflix saves $1b a year on better purchasing of content. (page 163 of the report)

- The nice succinct summary the new model is Digital Leaders = Transforming Media With Better User Experiences + Lower Prices…Data + Scale

So you have the background about the global challenges for cable companies what about Sky NZ? Well I have been doing some digging and it doesn’t take much analysis to realise that they are facing the exact same challenges and have been on the defensive for some time. The actions they are taking aren’t those of a company that are customer focused, looking to innovate and looking to win

Here are some of the comments that John Fellet said in the last annual report or press statements

- Content costs: At SKY we know that we do our customers no favour by paying whatever it takes to win every bid.We walk that fine line between trying to retain or obtain all the content our customers want yet acquiring it at a price they will accept. To me it’s corporate speak that is trying to say the cost of content is going up and we aren’t going to keep paying more for it as we can’t keep charging customers more.

- Looking at their half year results cost of content has gone up from 34% of revenue to 39% – this translates to another $30m of costs

- As with the international cable companies there is a significant price delta between sky and Netflix and Lightbox (Sky Basic and sport is ~$80 is while Netflix is $12.00). This is justified in the annual report with this quote: I think the biggest problem is that these services tend to be priced too low to be commercially viable.

- Churn rates have increased from 13.3% in 2012 to 17.7% in 2016. And net customer numbers have dropped 40,000 in one year.

- With increased content costs and lower subscribers you would think that Sky would be looking for new customers and new markets, like say digital… Well they kind of are

- Again from the annual report: The biggest concern any traditional pay television company has in launching these OTT services is ensuring that they expand your subscriber base as opposed to cannibalising it.

- Earlier in the report they mentioned they were all over it and there wasn’t much canabalisation or churn: Each month we look at all new internet based customers and so far we are seeing less than 3% of them were traditional SKY subscribers in the previous three months.

- So you would go hard on the channel with incremental revenue, wouldn’t you? Well not quite, what they did do is remove some of their online offerings, restricting customer options and choice and saying “As best as you try to cater for everyone, sometimes it is just not worth the effort,”

- There have been a couple of great pro active customer experience enhancements they have implemented as well (hint of sarcasm)

- The flashing subscriber number on your screen when you are watching the Lions so they can identify if you illegally stream it

- I love the conversation I had with Sky when I canceled, they told me if I cancel I wasn’t allowed to rejoin for another 6 months, was I sure I wanted to cancel? I know why they do this, to stop rotational churn when customers just sign up for the rugby season but really with their churn numbers do they really want to tell customers they aren’t welcome back?

- Then there is the joy of returning your Sky box to the pokey little shop in Mt Wellington.

- And by the way Sky knows what all of these changes are on the customer as they measure customer satisfaction through NPS. I would love to know their actually NPS – any guesses? http://www.getthematic.com/sky-tv-understand-your-subscribers/

I guess if you worked for Sky No one said it would be easy ……

And faced with the above what would you do? Answers on the back of a stamped self-addressed envelope, please

KS