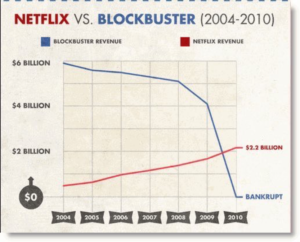

It was probably serendipitous that in the same week that Video EZY St Heliers closed it’s doors for the last time I saw this graph floating around a few posts on LinkedIn. It was way to good not to share.

This is possibly the starkest image I have seen of the new economy disrupting the old economy. We have previously spoken about the death of barriers to entry, and I am sure that Blockbuster through thought that they had scale and barriers to entry with a store in every town and street corner.

When I first saw this graph I like you saw the impact of disruption, a new and improved customer experience and business model destroying an old world business model. And then as I examined it I realised something deeper in this

The biggest observation from the graph is

While there has been a massive destruction of value with revenue peaking at $6.5b in 2004 down to $2.2b in 2010. This has resulted in massive benefits to the consumer. The consumer now has more choice, a better service at lower cost.

While I am sure that this will be a case study in many MBA programmes below is a quick overview of the key facts:

- At its peak Blockbuster had 4,000 US stores and 2,500 international stores and 10,000 “Blockbuster Express” rental kiosks. And worldwide at its peak in 2004, Blockbuster consisted of nearly 60,000 employees and over 9,000 stores.

- Netflix was founded on 1997 after founder was fined for a late return of a DVD from blockbuster, started with a pay-per-rent model: 50¢US-per-rental via mail, late fees applied

- Moved to monthly subscription (all you can eat in 1999)

- 35,000 titles – much like Amazon giving it the ability to manage the long tail that a physical store couldn’t

- In 2000 Netflix was offered for sale for $50m to Blockbuster however they turned it down as Blockbuster was still growing and believed that they didn’t need Netflix subscriptions service.

- 2004, Blockbuster introduced aDVD-by-mail service in the U.S. to compete with Netflix

- By 2006 this service had 2million customers however it was creating a channel conflict

- Southern Stores Inc., one of Blockbuster’s largest franchise filed a lawsuit alleging mail service undercut the group’s franchise agreement.

- In 2007 Netflix started to stream video on demand with 1000 videos

What are some key observations….

- Blockbusters original strengths ended up being the millstone. Their foot print and franchise model that allowed them to rapidly grow ultimately held them back. Their perceived barriers to entry became a week spot. Much of the folk lore around this chastises Blockbuster for not buying Netflix in 2000. While, at the time Netflix was close to going under I am sure the reason they didn’t buy it was…

- Channel Conflict – this would play out in 2006. If Blockbuster saw the channel conflict in 2000 what did the do to try to resolve it?

- Not invented here? I am sure that Blockbuster thought that they could build this service themselves, and therefore why pay $50m for it. The didn’t launch the service until four years after the original offer.

- I am guessing they didn’t see the customer demand. They already had a store on every corner, their research was probably telling them that consumers probably enjoyed the impulse of deciding to watch a video, and the experience to browsing the shelves. What they probably didn’t do is segment their customers and identified the high valued customers had wide viewing habits and rented multiple times a month – perfect for a subscription model.

- Anticipate, customer and the technology changes

- Meanwhile Netflix did some great things

- They original based their business off a customer pain point (late fees) that applied to only a small segment but that segment would grow in importance.

- They had a long term view of strategy, they looked into the future and anticipated the change in technology and how that would impact their business, and invested while still driving their core business. When customers transitioned they were ready.

- Maybe not by design but the learnings from algorithm they used to recommend dvd rentals could easily be ported to online video streaming (and became one of the key features)

Key Takeaways

- Right now someone is looking at your business as trying to figure out how they can get a slice of it, even a small slice, maybe even at irrational pricing

- You will hear about them, maybe they will pitch to sell to you.

- You will say no, you are protected and you can do it yourself so…

- The question is Do you feel lucky punk?

KS