Last week saw the release of the latest radio surveys (ie, the all important audience figures).

Commercial radio in NZ is a virtual duopoly, with MediaWorks and NZME taking turns to whack on each other. So I guess it shouldn’t surprise both sides “see” the latest results as victories. Even so, I’m struggling to see Paul Henry a surprise winner in radio survey in the same space as Hosking dominates breakfast radio.

The release of the numbers saw further PR salvos – Dean Buchanan (managing director NZME Radio) was “…rapt with today’s results. Newstalk ZB will just continue to strengthen further with Marcus Lush joining the team”. He also claimed “ZM is on fire with loads more growth potential… it’s a great day to be number one”.

Hmmm…

I completely understand the rhetoric. In a two player market appearance is all, and moves in share mean moves in revenue. But…

These announcements are shy any comment on the real-world challenges facing radio.

Total market audience figures give a reality check – total audience dropped by 7.9%. Drilling into ZM and The Edge (as a proxy for youth) 9.2% of the audience disappeared. These are big numbers to be deserting radio – the impact of audience loss is clearly seen in NZME Radio’s results, where revenue dropped 2% in 2014. However, there was more to the story than meets the eye, agency revenue (the largest and most sophisticated advertisers deserted NZME radio a massive 13% in Q2.

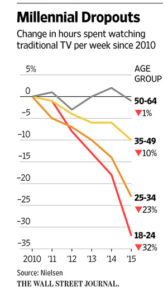

And if you think this is grim, the future looks even worse for traditional TV.

Chiming with this is a graph from WSJ. The 18-24 demographic shows a 1/3 drop in hours spent watching traditional TV… in only a five year period.

TV is pushing on demand and online services to arrest this decline. So is NZME with iHeart Radio. Papers and cracks… these attract audience but mean little without thought through corresponding (and company-wide) commercial strategies to arrest cash declines.

Advertising carries less impact in digital channels. Global forecasts see TV losing between between 1-3% of advertising revenue share in the next 5 years globally, but guess what this again is masked by the fact that it is only really emerging markets that are growing.

You’re thinking – 1-3% isn’t much versus the general audience decline, right? And you’re right.

The issue is – media companies work on thin margins already. TVNZ had revenue of $336m and profit of $25m in 2014. Profit margins are so finely tuned that on those numbers a 7% drop in revenue would completely wipe out TVNZ’s profit.

Here in NZ our smaller base is driving us faster to the sharp end of disruption for traditional media. To assume things will change is wishful at best, misleading at worse. The challenge for media companies is to show how they will adapt, versus hacking at each other over smaller pieces of an increasingly decreasing pie.

The options of cutting are diminishing (to gone), so it will be fascinating to see which of them can pivot into a real-world place, based on a genuine understanding of where their audience and clients have gone. Despite executive comment on the healthy state of media most realists get that inaction is making the future worse. The fear is significant pain lies ahead.

Key Takeaways

- Topline numbers can give a false sense of security. Is your business realistic in its world view?

- What do you see when you look closely at your lead indicators? Comfort or trouble?

- If trouble… how are you tackling that?

- Strategy and leadership is all about understanding trends and identifying the future shape of your business. It’s difficult to achieve when you’re in the trenches… do you carve out time to understand and plan for the future?