Last week’s post mentioned a new trend commonly associated with millennials – access rather than ownership. Sometimes called the sharing or on-demand economy, it’s a shift in customer thinking most businesses today should be exploring in depth.

Rapid changes in technology have created reluctance in millennials to buy (or own). There are two main reasons – the changes can sometimes rapidly render this year’s cutting edge model obsolete, whilst at the same time advances in tech increase market efficiency, making ownership less necessary and ultimately undesirable. It’s at this point that increasing numbers of millennials embrace the sharing economy.

This change has been so pronounced, and with the rise to dominance of millennials, seemingly so inevitable, that economists like Jeremy Rifkind believe “25 years from now, car sharing will be the norm… car ownership the anomaly”

At the highest level the business model involves trade in goods and services based on access rather than ownership. Usually empowered via a cloud based platform (allowing for global uniformity/access), and engaged with via smartphone, the platform acts as a connector of suppliers willing to rent assets (e.g., Uber for Cars, Spotify for music, AirBnb for accommodation) with consumers. Using a platform to directly connect suppliers to consumers increases market efficiency by reducing the need for intermediaries (taxi companies, record stores, hotels and travel agents) to connect the buyer and seller.

Adding additional efficiency and value, many of these platforms flex supply to demand by engaging contractors rather than employees.

Consumers gain value through vastly reduced capital outlay to access a service (ie, not having to purchase a car). Suppliers gain value by selling excess capacity they may not otherwise not use, providing ongoing returns for assets already paid for.

One example of is https://turo.com/. The platform lets consumers connect with suppliers willing to rent out their private vehicles, often during working hours when the cars would otherwise simply be parked up. www.airbnb.com is another good example, this time letting suppliers rent out apartments or spare rooms to consumers. Directly connecting this “excess capacity” between suppliers and consumers allows for removal of intermediaries, delivering lower prices and therefore driving increased demand.

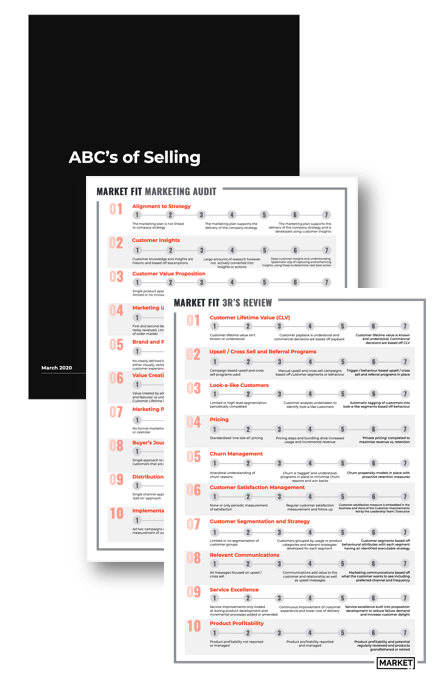

A previous blog of mine (Death of Barrier of Entry?) looked at how the advent of digital business often removes or marginalises barriers to entry, creating a more competitive, efficient market. The conclusions and actions remain the same:

- Businesses need to critically review barriers to entry in your sector and war game how they could be overcome

- Businesses need to critically examine where they add value to buyer and seller

Steve Denning of Forbes.com has a good summary of strategies if your critical analysis shows you are on the wrong side of disruption:

1, Consider legal and regulatory means to hold back the tide. Warning… see Taxi Federation for the likely outcome of this approach.

2, If you can’t beat ‘em, join ‘em. Consider ways you can pivot your business to embrace sharing or access – and remember you may have some advantages to hand through your own unused resources.

3, Move your business from product selling to wider solution selling. De-emphasising the sale of “things” and refocusing business practices on managing every aspect of a client’s value chain increases your value to a customer. If you have experience in your field, becoming a “solution provider” is often a very canny move.

And finally, spend some time understanding your position in the value chain. Achieving an honest clarity around this will let you see whether this disruptive change in economics and business model is an opportunity or threat.